Tsubaki’s Corporate Philosophy

Tsubaki Spirit is the corporate philosophy shared throughout the Tsubaki Group.

To achieve our social mission and aspiration, we also rely on our founding philosophy and five principles of action.

Social Mission

Advance the “art of moving” beyond expectations

Aspiration

Monozukuri specialists taking the craft of manufacturing to new heights

Tsubaki’s History

Tsubakimoto Chain has been in business for more than 100 years.

Scroll

Scroll

Challenge New Fields under

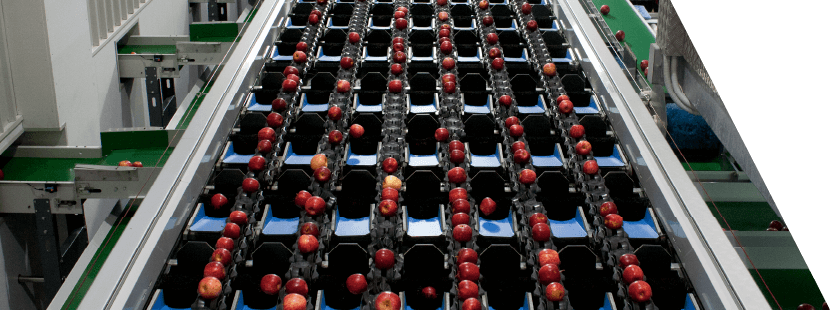

Tsubaki’s Four Main Businesses

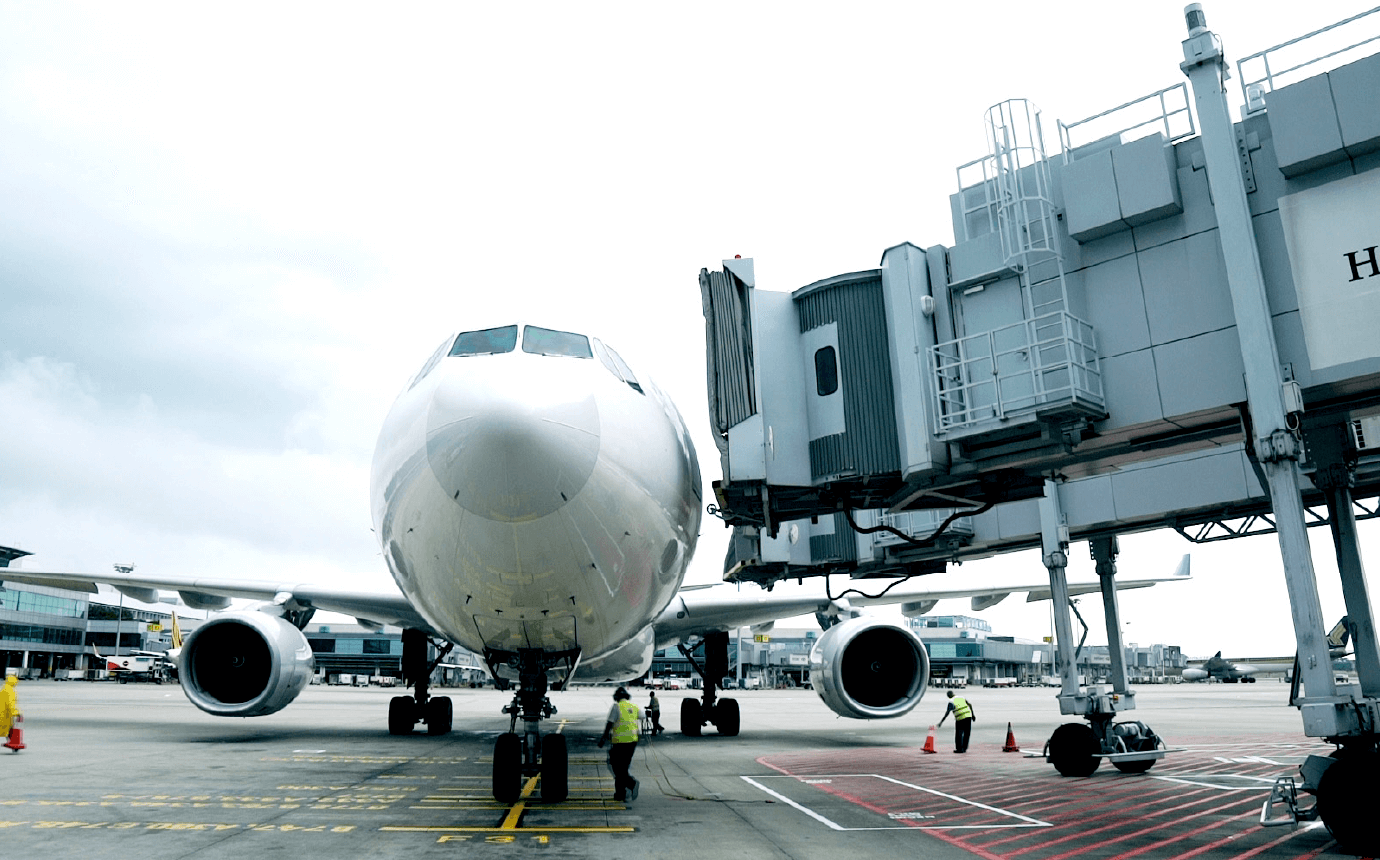

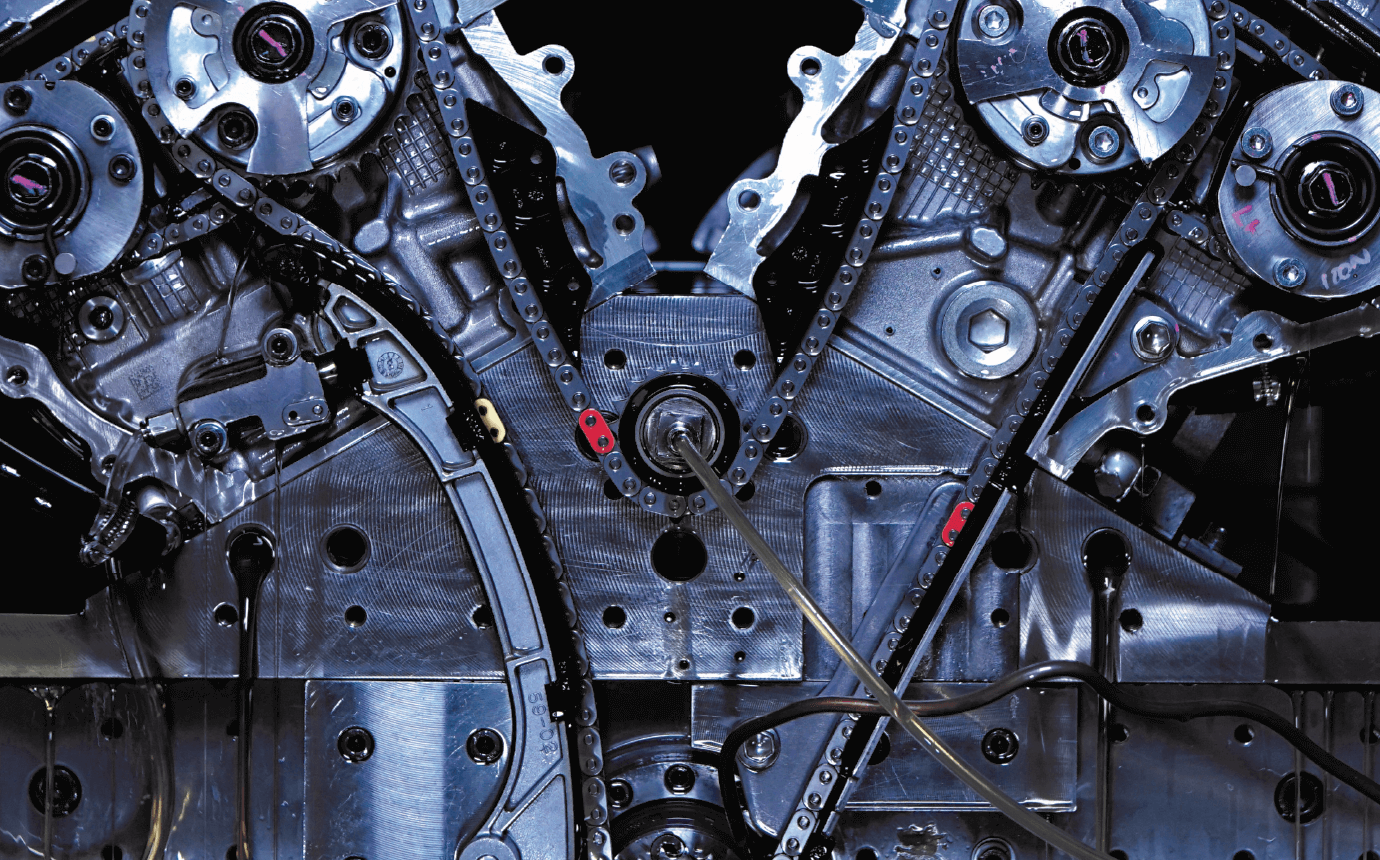

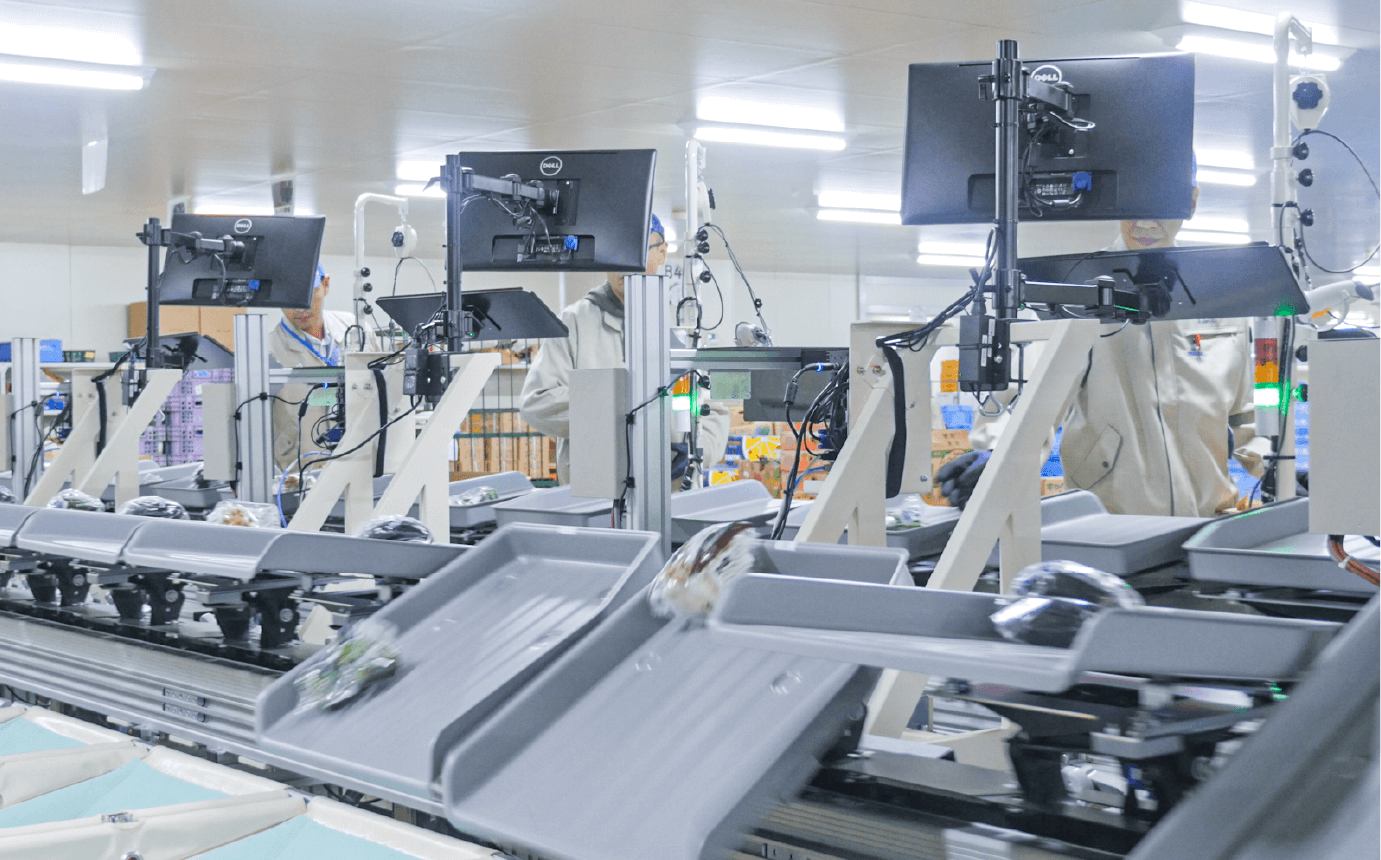

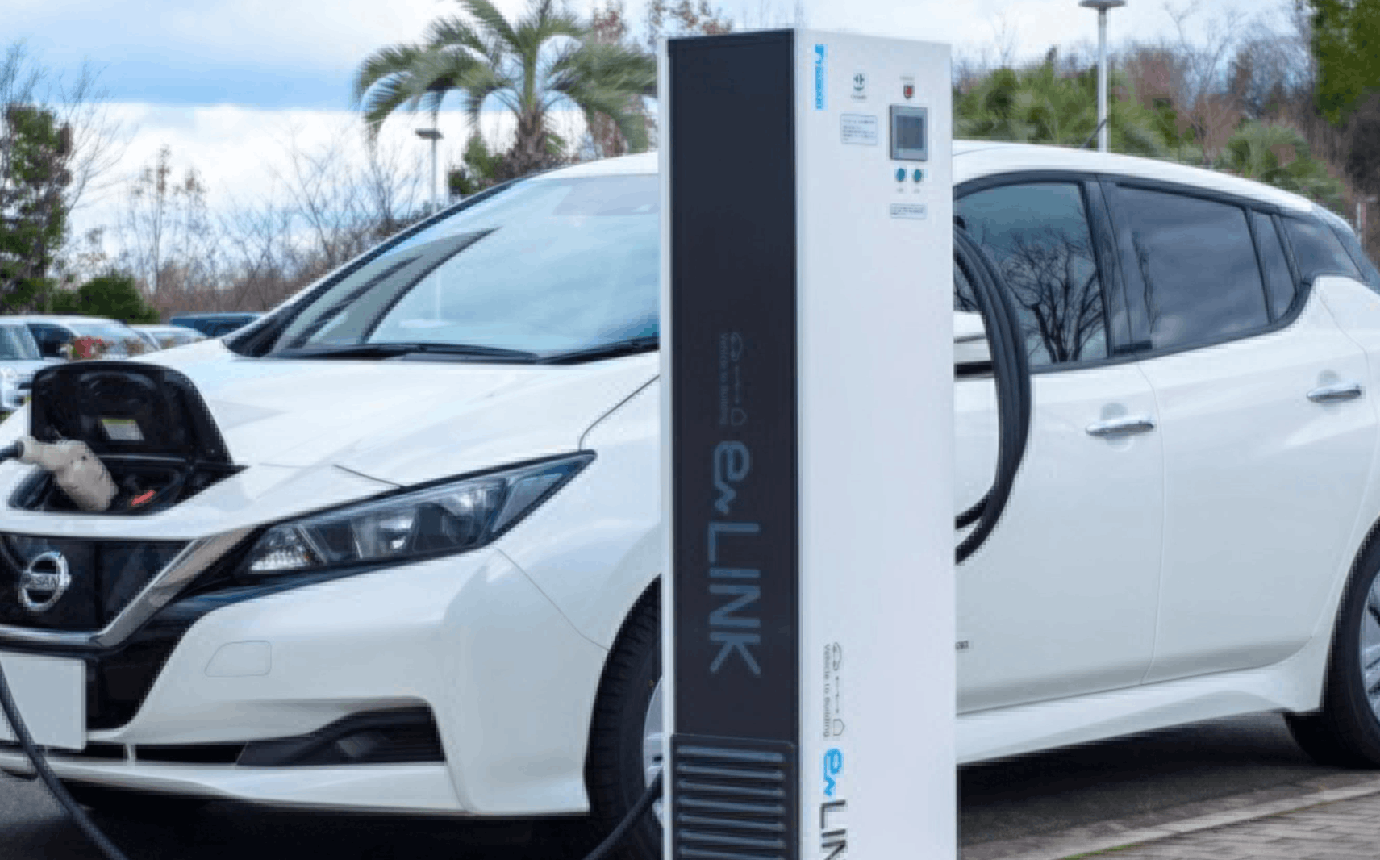

Tsubaki’s diverse variety of products are used in a wide range of fields for various applications.

Tsubaki’s Four Strengths

Since its founding in 1917, the Tsubaki Group has focused on reinforcing its strengths in value creation, with such efforts becoming the foundation of further growth.

Providing value that exceeds expectations

Expertise in providing solutions

- Numerous examples of solutions that meet customer needs

- A record of supplying the world’s top manufacturers

Product development capability

- Products with the leading share of the global market

- Provision of Eco Products (SDG-oriented Products)

Expertise in manufacturing

- Preserving the expertise cultivated through 100 years of manufacturing with outstanding skill and advanced technology

- Provision of safe, reliable and superior quality products

Global readiness

- Establishing a global network of 81 companies in 26 countries and regions

1. Expertise in providing solutions

- Numerous examples of solutions that meet customer needs

- A record of supplying the world’s top manufacturers

2. Product development capability

- Products with the leading share of the global market

- Provision of Eco Products (SDG-oriented Products)

3. Expertise in manufacturing

- Preserving the expertise cultivated through 100 years of manufacturing with outstanding skill and advanced technology

- Provision of safe, reliable and superior quality products

4. Global readiness

- Establishing a global network of 81 companies in 26 countries

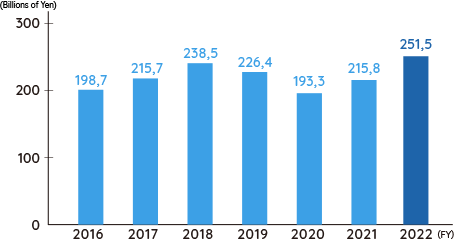

Tsubaki by the Numbers

* Data taken from FY 2022 results.

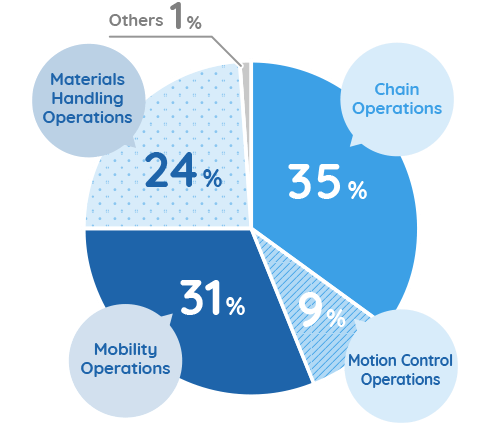

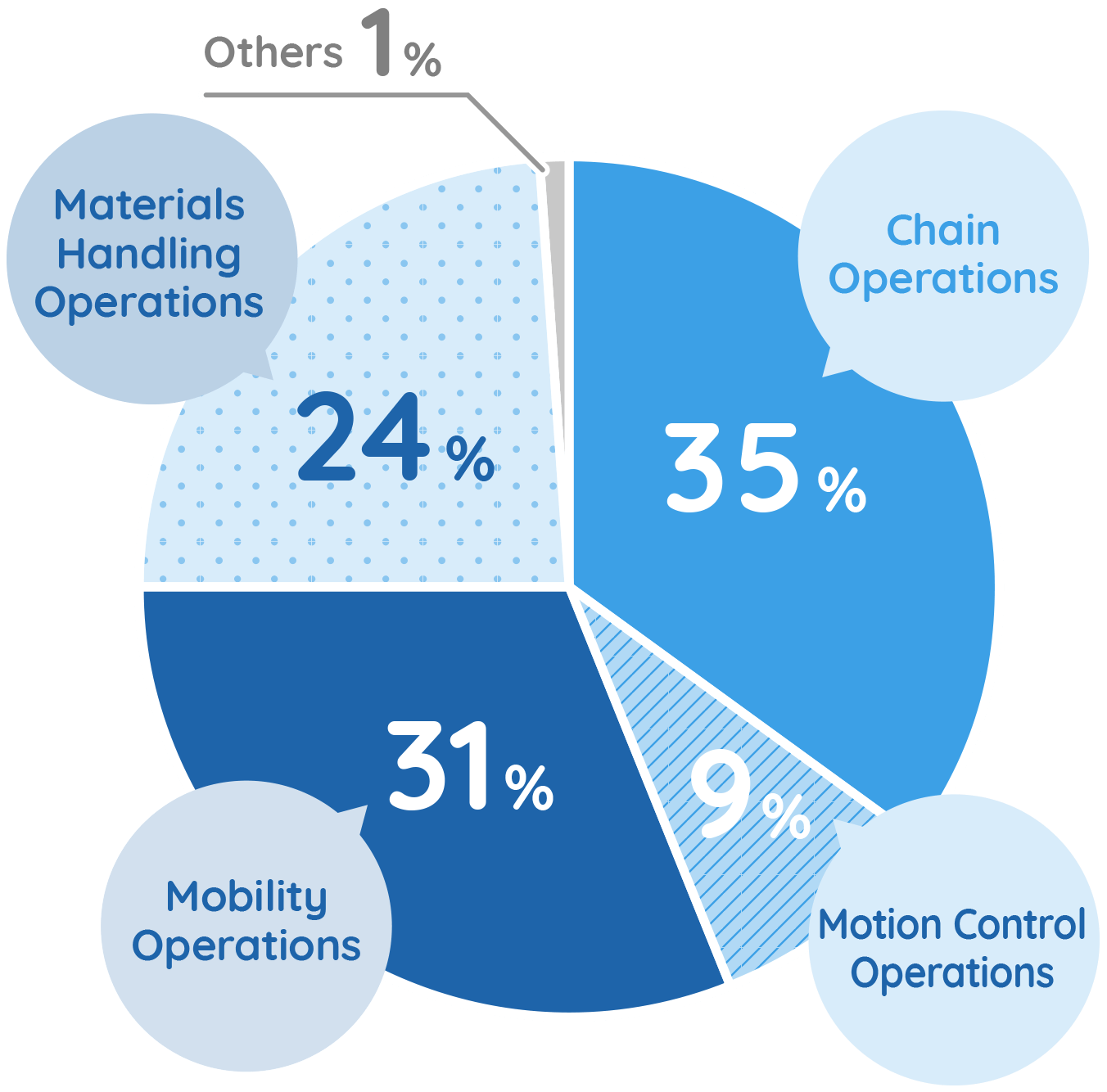

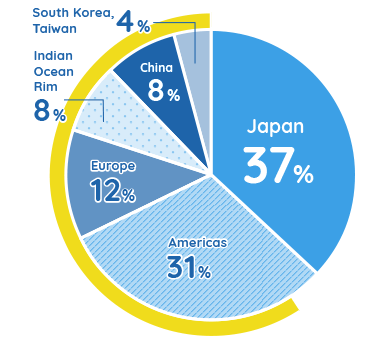

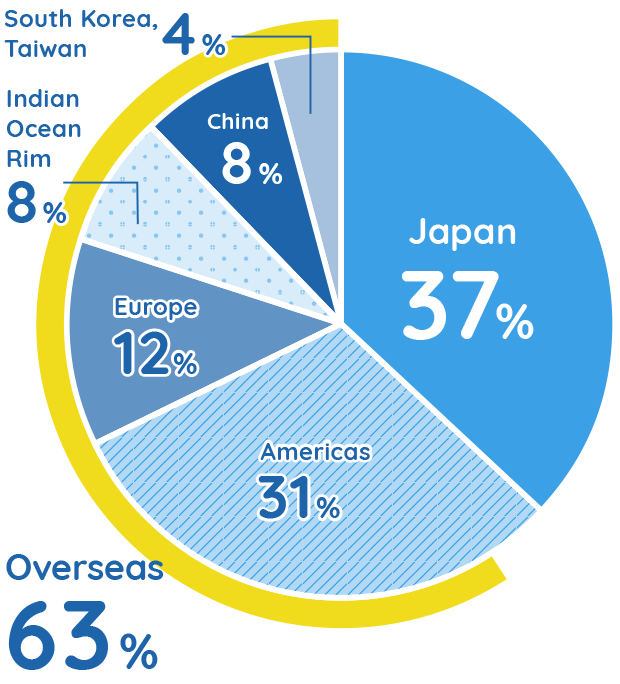

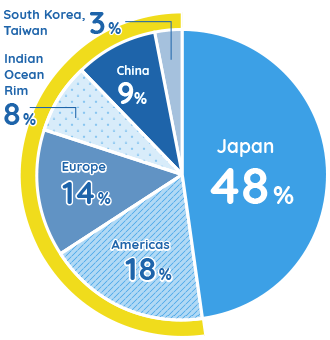

Sales by Business Segment

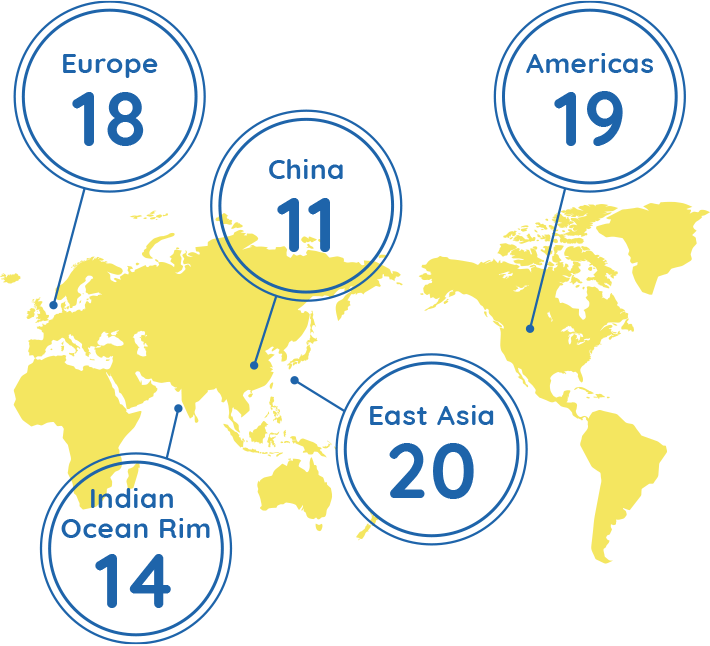

No. of Overseas Bases

82 companies in

26 countries and regions

Total No. of Employees

8,691

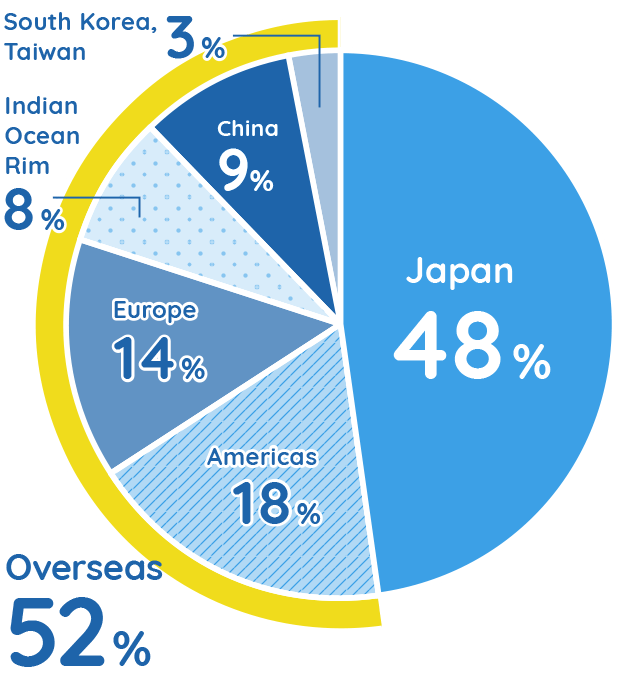

Overseas Sales Ratio

63%

Overseas Employee Ratio

52%

Tsubaki’s

Sustainability Plan

As a manufacturing company, we offer unique innovations for addressing various social issues in an effort to achieve a sustainable society.

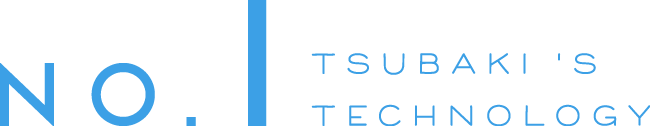

Tsubaki as a Global Leader

* Data based on in-house research

Top global market share

Tsubaki claims the world’s largest share of industrial steel chains and automobile timing chains.

More than a simple boast, this is proof of Tsubaki’s superior quality, performance, and global production and service systems. * Shares based on in-house research

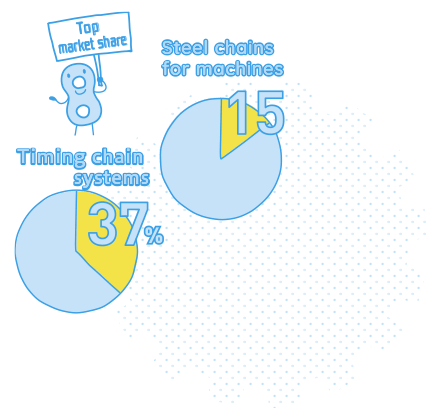

World’s smallest chain

World’s largest chain

Tsubaki’s smallest chain has a pitch of just 3.7465mm—the smallest in the world at about the size of an ant.

These chains are often used for medical and office equipment.

Tsubaki’s largest chain has a pitch of 1.2m—the largest in the world.

This chain is used for conveying iron ore at steelmaking plants.

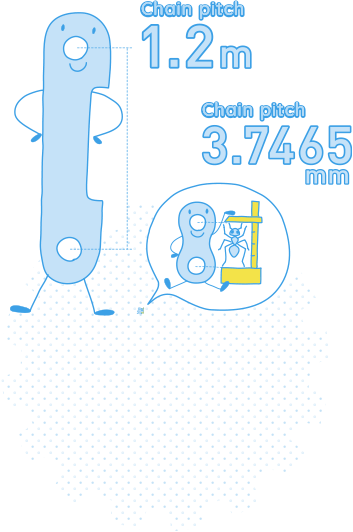

World’s highest tensile strength

Draw bench chains used in steelmaking plants have a mean tensile strength of 1600 tons.

This is a tensile strength equivalent to 40 Shinkansen Nozomi trains.

World’s first

zipper-type chain

Our Zip Chain—the first of its kind to be developed—includes two separate chains engaging like a zipper to form a single solid pillar.

Zip Chains create a “steel pillar” out of two previously flexible chains. With ultra-high-precision stopping in units of 1mm, Zip Chains are durable and can be used at high speeds, making them useful for lifting equipment in automobile plants and for stages.

Ultra-low-temperature

high-tech refrigerator

The Tsubaki LaboStocker 150L is the world’s first high-tech refrigerator. The ultra-low-temperature (−150°C) environment inside this industry-first refrigerator is ideal for storing cells, blood, and DNA for tens of thousands of people.

The device is also capable of speedy loading and unloading of the required samples automatically and accurately. This is our contribution to the evolution of cutting-edge medical treatment such as for cancer and iPS cell treatments.

World’s largest

production volume

Tsubaki produces about 30,000km of RS roller chains and timing chains every year.

This is enough chain to go 3/4 of the way around the earth (which has a circumference of about 40,000km).

In other words, Tsubaki produces enough chain to stretch from Osaka across Europe to New York.

Toward a Sustainable Society

The Tsubaki Group is engaged in the “art of moving” and aims to provide value that exceeds expectations

to become a company that continues to be needed by society.