Consolidated Results Highlights

Financial Data for Past Five Years

-

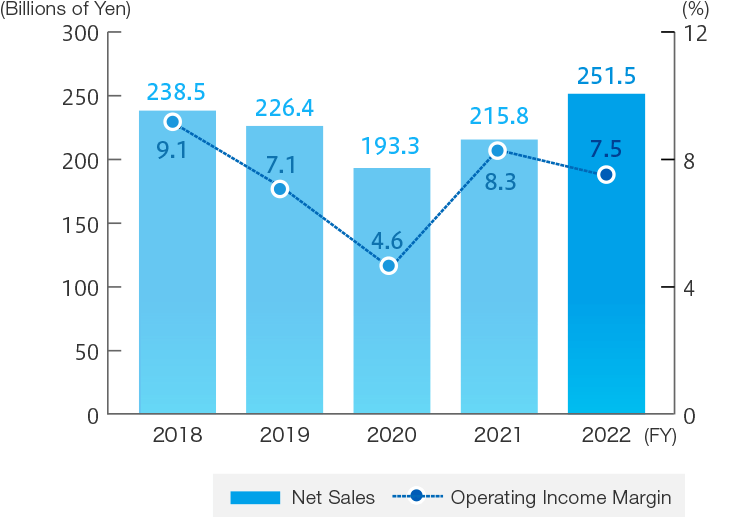

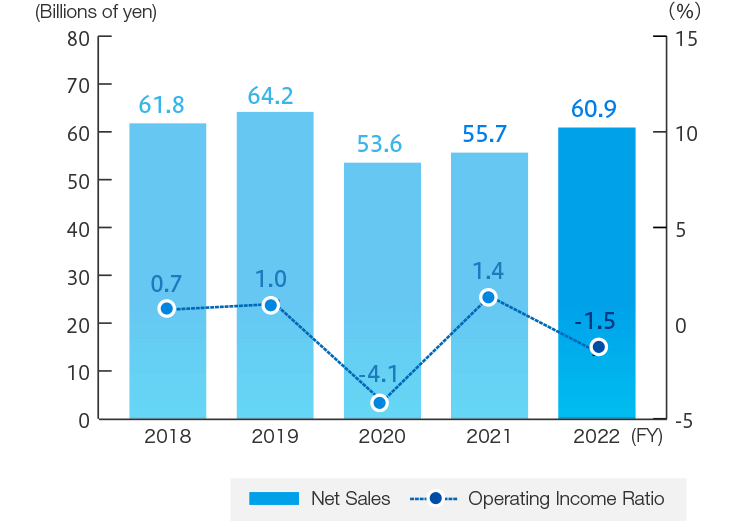

Net Sales and Operating Income Ratio

-

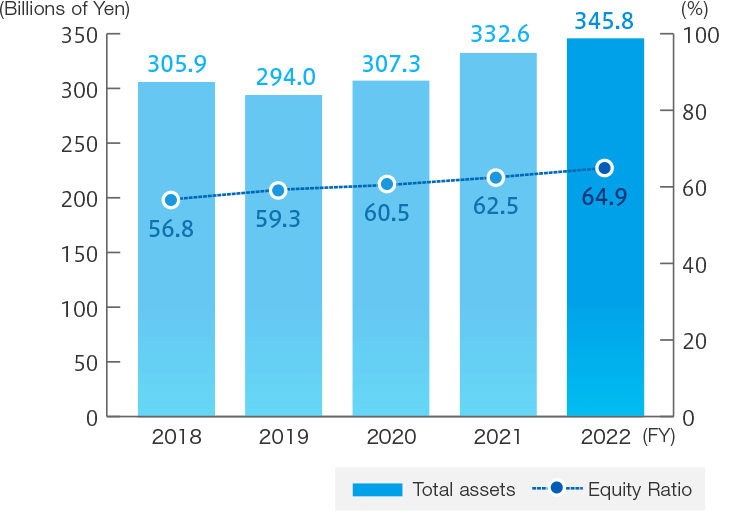

Total Assets and Equity Ratio

-

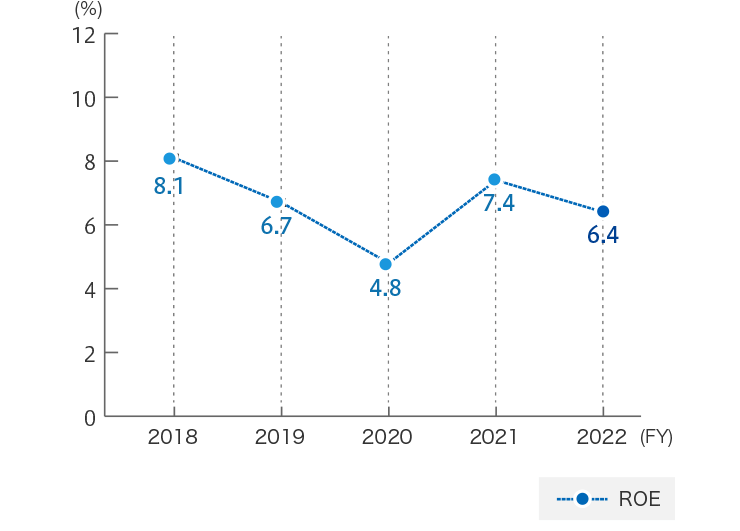

ROE (Return on Equity)

Consolidated Operating Performance

(Millions of yen)

| Fiscal Year | FY 2018 | FY 2019 | FY 2020 | FY 2021 | FY 2022 |

|---|---|---|---|---|---|

| Net sales | 238,515 | 226,423 | 193,399 | 215,879 | 251,574 |

| Operating income | 21,789 | 16,146 | 8,896 | 17,842 | 18,985 |

| Operating income ratio | 9.1% | 7.1% | 4.6% | 8.3% | 7.5% |

| Net income attributable to parent company shareholders | 13,779 | 11,576 | 8,706 | 14,543 | 13,742 |

| Net income per share | 364.03 yen | 308.71 yen | 235.23 yen | 392.88 yen | 371.12 yen |

| ROE (Return on Equity) | 8.1% | 6.7% | 4.8% | 7.4% | 6.4% |

* The table can be scrolled horizontally.

* We consolidated common shares at a ratio of 5 to 1 on October 1, 2018. Net income per share figures are calculated assuming that we consolidate common shares at the beginning of the previous fiscal year.

No consideration is given to share consolidation for dividends from the previous fiscal year.

* ROE = Return On Equity (Net income/Shareholder’s equity)

Consolidated Balance Sheets

(Millions of yen)

| Fiscal Year | FY 2018 | FY 2019 | FY 2020 | FY 2021 | FY 2022 |

|---|---|---|---|---|---|

| Total assets | 305,916 | 294,098 | 307,332 | 332,620 | 345,878 |

| Net assets | 173,734 | 174,360 | 185,791 | 207,756 | 224,398 |

| Equity ratio | 56.8% | 59.3% | 60.5% | 62.5% | 64.9% |

* ROE = Return On Equity (Net income/Shareholder’s equity)

Results by Segment

Performance Trends by Business Segment

-

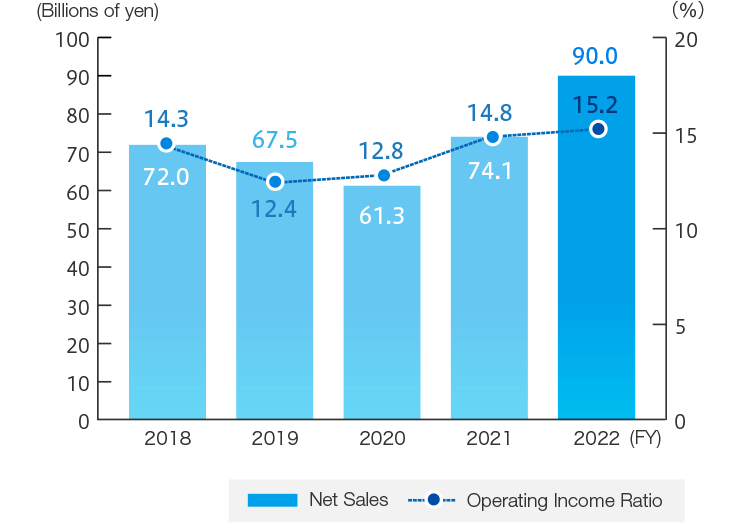

Chain Operations

-

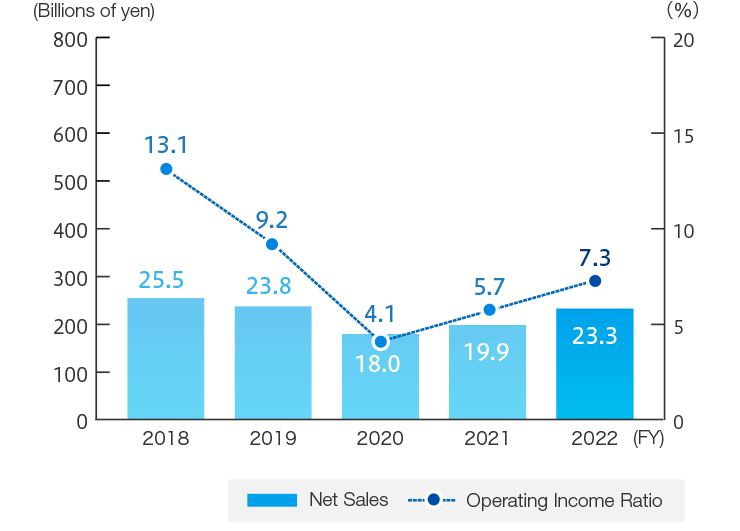

Motion Control Operations

* The name of this segment has been changed from PTUC as of April 1, 2021.

-

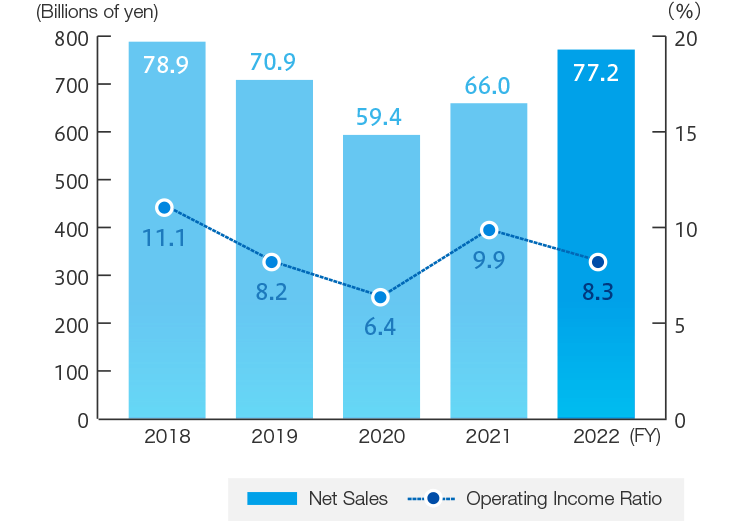

Mobility Operations

* The name of this segment has been changed from Automotive parts as of April 1, 2021.

-

Materials Handling Operations

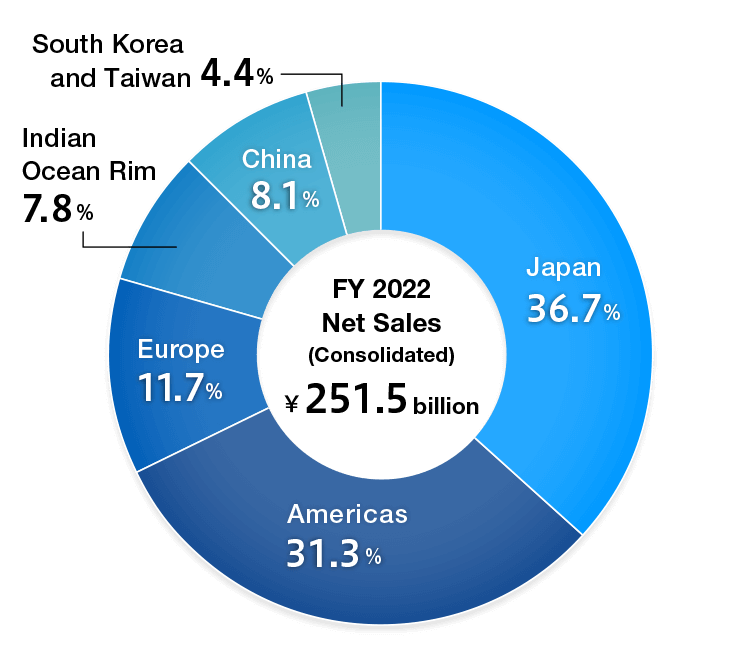

Regional Sales Breakdown