Consolidated Results Highlights

Financial Data for Past Five Years

-

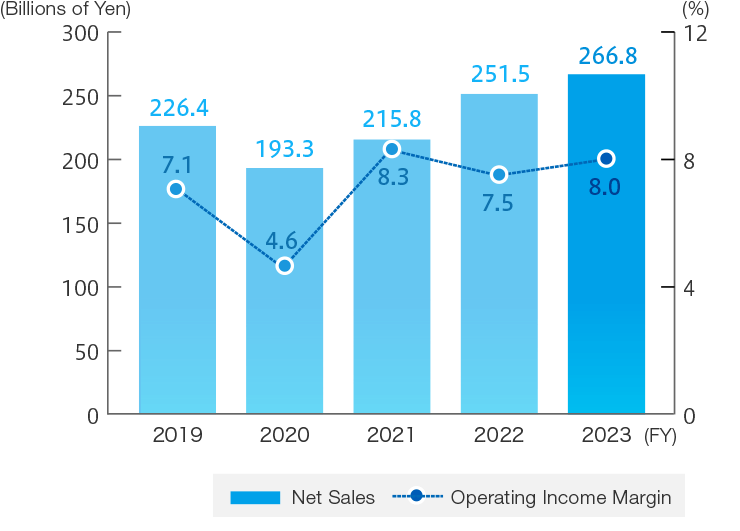

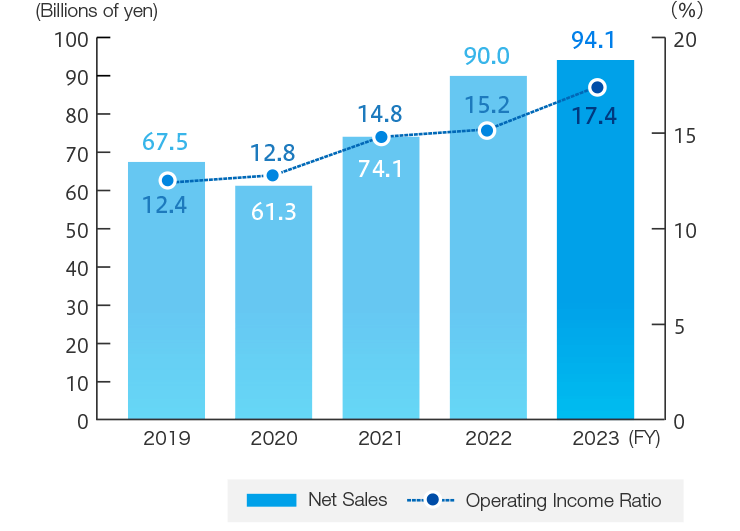

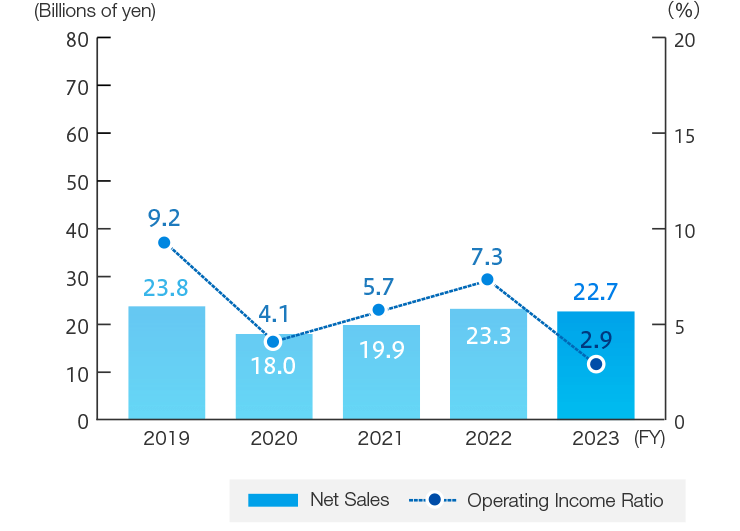

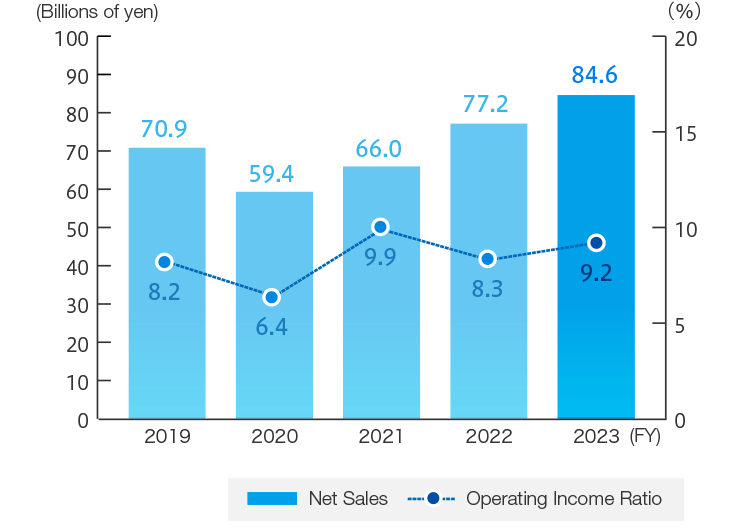

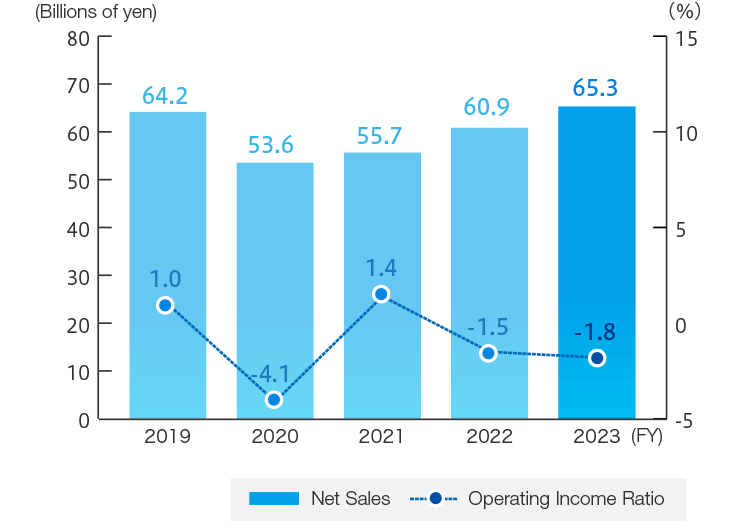

Net Sales and Operating Income Ratio

-

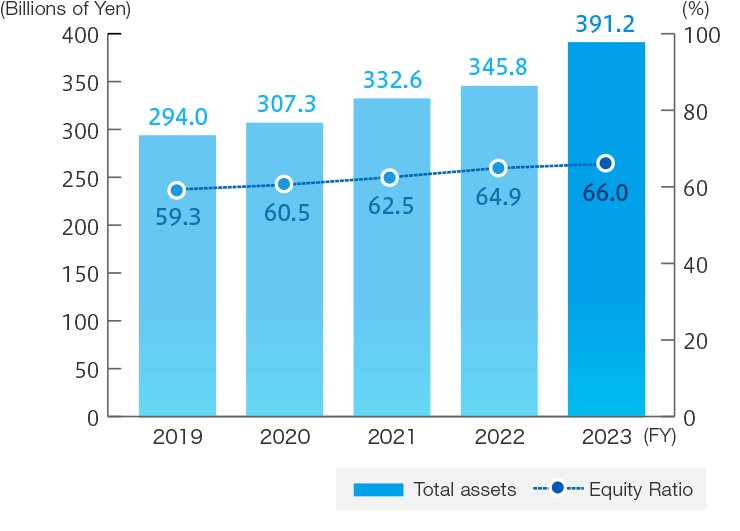

Total Assets and Equity Ratio

-

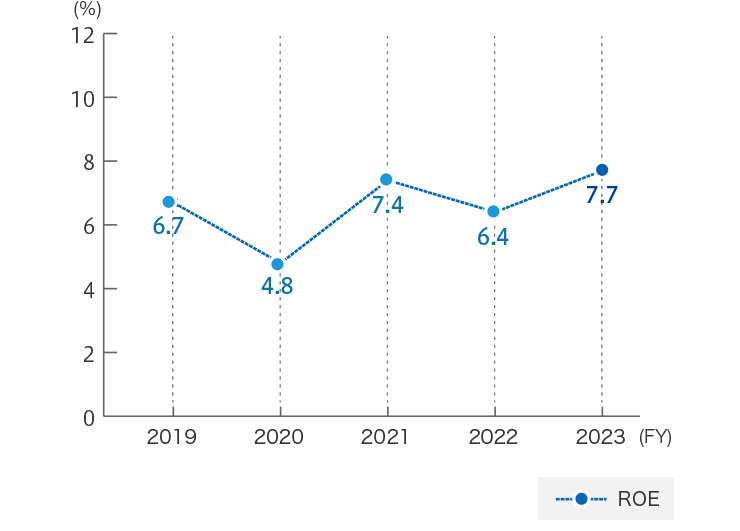

ROE (Return on Equity)

Consolidated Operating Performance

(Millions of yen)

| Fiscal Year | FY 2019 | FY 2020 | FY 2021 | FY 2022 | FY 2023 |

|---|---|---|---|---|---|

| Net sales | 226,423 | 193,399 | 215,879 | 251,574 | 266,812 |

| Operating income | 16,146 | 8,896 | 17,842 | 18,985 | 21,262 |

| Operating income ratio | 7.1% | 4.6% | 8.3% | 7.5% | 8.0% |

| Net income attributable to parent company shareholders | 11,576 | 8,706 | 14,543 | 13,742 | 18,551 |

| Net income per share | 308.71 yen | 235.23 yen | 392.88 yen | 371.12 yen | 511.65 yen |

| ROE (Return on Equity) | 6.7% | 4.8% | 7.4% | 6.4% | 7.7% |

Consolidated Balance Sheets

(Millions of yen)

| Fiscal Year | FY 2019 | FY 2020 | FY 2021 | FY 2022 | FY 2023 |

|---|---|---|---|---|---|

| Total assets | 294,098 | 307,332 | 332,620 | 345,878 | 391,298 |

| Net assets | 174,360 | 185,791 | 207,756 | 224,398 | 258,400 |

| Equity ratio | 59.3% | 60.5% | 62.5% | 64.9% | 66.0% |

Results by Segment

Performance Trends by Business Segment

-

Chain Operations

-

Motion Control Operations

-

Mobility Operations

-

Materials Handling Operations

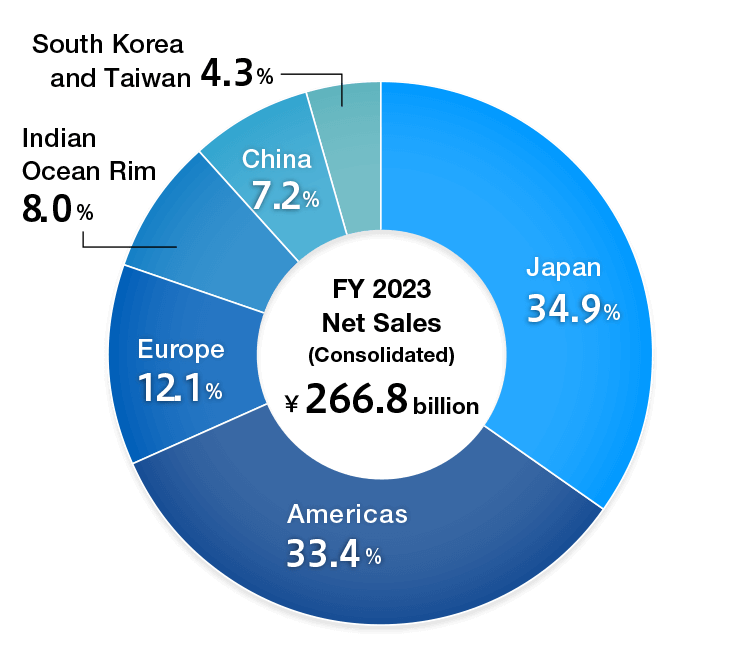

Regional Sales Breakdown