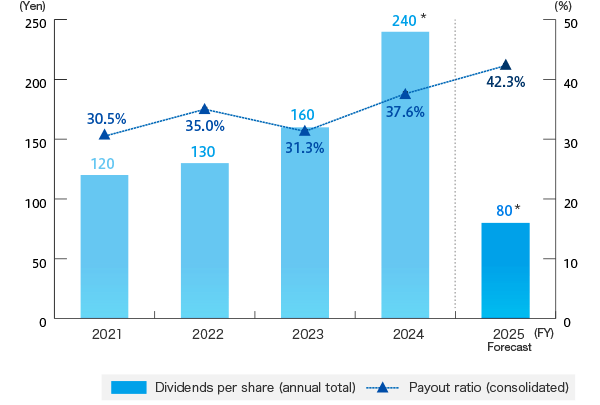

Returns/Dividends to Stockholders

Basic Policy on Profit Distribution

The return of profits to our shareholders is one of our highest management priorities. The Tsubaki Group’s basic profit allocation policy calls for consolidated results to be reflected in dividend payments in terms of emphasizing our shareholders. Funding status and financial standing will also be comprehensively considered as we aim to raise Tsubaki’s consolidated dividend payout ratio to at least 35%.

Meanwhile, we use retained cash to strengthen our financial position and for future business development.

Regarding the full-year dividend for FY 2025, the Company plans to pay an interim dividend of 40 yen per share and a year-end dividend of 40 yen per share in accordance with the consolidated results forecast and the aforementioned policy.

Dividends and Dividend Payout Ratio (Consolidated) Trends

* Effective October 1, 2024, the Company split its common shares at a ratio of 1 to 3. The total dividend for FY 2024 was calculated without factoring in the impact of the stock split. The total dividend per share for FY 2024 factoring in the stock split is 80 yen per share. The forecast for the total dividend per share for the FY2025 reflects the amount after the stock split.