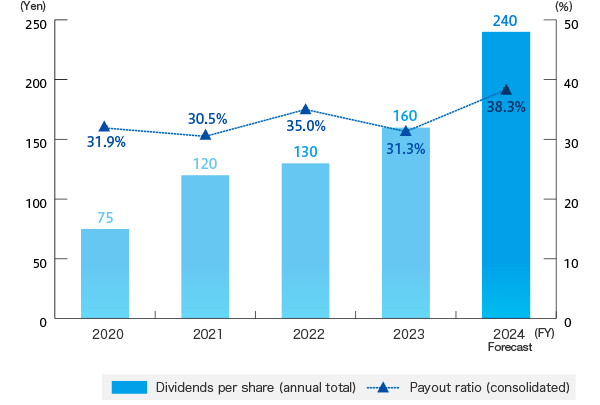

Returns/Dividends to Stockholders

Basic Policy on Profit Distribution

The return of profits to our shareholders is one of our highest management priorities. The Tsubaki Group’s basic profit allocation policy calls for consolidated results to be reflected in dividend payments in terms of emphasizing our shareholders. Funding status and financial standing will also be comprehensively considered as we aim to raise Tsubaki’s consolidated dividend payout ratio to at least 35%.

Meanwhile, we use retained cash to strengthen our financial position and for future business development.

Regarding the full-year dividend for FY 2024, the Company plans to pay an interim dividend of 99 yen per share and a year-end dividend of 141 yen per share in accordance with the consolidated results forecast and the aforementioned policy.

Dividends and Dividend Payout Ratio (Consolidated) Trends

* The Company plans to conduct a 3-for-1 stock split of shares of common stock, effective October 1, 2024.

The forecast for the year-end dividend for FY 2024 was calculated without factoring in the impact of the stock split.

The year-end dividend per share for FY 2024 factoring in the stock split is 47 yen per share.

For details, please see “Summary Information 2. Dividends” in the “Consolidated Financial Results for the Year Ended March 31, 2024 [Japanese GAAP]” released on May 14, 2024.