Corporate Governance

Basic Concept

Tsubakimoto Chain Co. regards enhancing corporate governance as one of the most important management tasks to create value for customers and contribute to society.

We have thus formulated this approach into the basic corporate governance policy stated below and strive to improve the corporate governance.

Basic Corporate Governance Policy

Rights of Shareholders and Securing Equal Treatment

Tsubakimoto Chain Co. (the “Company”) shall respect the rights of shareholders, ensure their fair and equal treatment, and endeavor to maintain an environment where the rights of shareholders can be properly executed.

Appropriate Cooperation with Stakeholders Other than Shareholders

Under the corporate philosophy “TSUBAKI SPIRIT,” the Company shall endeavor to enhance and maintain the relationship of trust with every stakeholder.

Ensuring Appropriate Information Disclosure and Transparency

The Company shall commit to continuously and proactively disclosing information to all stakeholders, including shareholders and investors, in a timely, accurate, and fair manner, and regards such as the basic stance of the disclosure policy. The information disclosed by the Company shall be made available on the corporate website.

Responsibilities of the Board

The board shall instruct and/or supervise the Company not only to ensure compliance with laws and regulations but also to operate in an efficient and transparent manner, while striving to increase competitiveness of the Company in ever changing business environments.

We will enhance and expedite the decision-making of the Board of Directors, focus on strategy formulation, strengthen the level of oversight over operational execution, and improve management efficiency by clearly separating strategy formulation and oversight by the Board of Directors and operational execution by executive officers.

Through the appointment of outside directors and outside Audit & Supervisory Board members, we will seek to enhance the independence of the Board of Directors, strengthen the oversight function and transparency of business management, and increase corporate value.

Dialogue with Shareholders

The Company will pursue “sincere and transparent management” and “diligent attention to the interests and concerns of shareholders,” and will enhance dissemination of information as well as its quality and volume in communicating with shareholders.

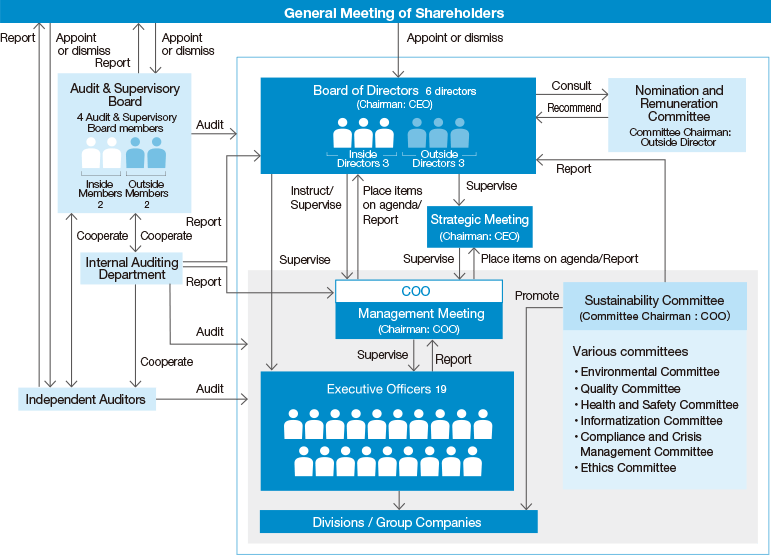

Promotion System

The Company draws a clear line between strategy formulation and oversight by the Board of Directors and business execution by the COO and the executive officers who are also members of the Management Meeting. Furthermore, the Company positions the Strategic Meeting, as the second-highest decision making body in the Company after the Board of Directors, responsible for deliberating and making decisions regarding important Groupwide business strategies and management policies.

Overview

| Organizational structure | Company with Auditors |

|---|---|

| Number of directors | 6 (of which 3 are outside directors) |

| Term of office of directors | 1 year |

| Chairman of the Board of Directors | Chief Executive Officer (CEO) |

| Number of the Audit & Supervisory Board members | 4 (of which 2 are outside Audit & Supervisory Board members) |

| Number of independent board members | 3 outside directors and 2 outside Audit & Supervisory Board members |

| Number of meetings of the Board of Directors | 14 (FY 2024) |

| Number of meetings of the Audit & Supervisory Board | 17 (FY 2024) |

| Number of meetings of the Nomination and Remuneration Committee | 4 (FY 2024) |

Corporate Governance Structure

Skill Matrix of Board Members

| Name | Position and Responsibility in the Company | Corporate Management | Global Experience | Technology/ Development/ Production |

Sales/ Marketing |

Finance/ Accounting |

Legal Affairs/ Compliance |

Risk Management |

|---|---|---|---|---|---|---|---|---|

| Kenji Kose |

Chairman and Representative Director Chief Executive Officer (CEO) |

|||||||

| Takatoshi Kimura |

President and Representative Director Chief Operations Officer (COO) |

|||||||

| Masaki Miyaji |

Director | |||||||

| Keiichi Ando |

Director | |||||||

| Hisae Kitayama |

Director | |||||||

| Takashi Tanisho |

Director | |||||||

| Koji Tanaka |

Audit & Supervisory Board Member | |||||||

| Kazuya Kawasaki |

Audit & Supervisory Board Member | |||||||

| Kiyotaka Kawasaki |

Audit & Supervisory Board member | |||||||

| Takaaki Yamamoto |

Audit & Supervisory Board member |

Note: The above table indicates a maximum of three of the main skills possessed by each director, rather than representing all of their skills.

Measures Taken for Corporate Governance

The Company has implemented the following management structure reforms to enhance the independence of the Board of Directors, to invigorate discussions at meetings of the Board of Directors on strategies for medium-to-long term growth, and to strengthen the supervisory function of the Board of Directors over the business execution.

| FY 2004 |

|

|---|---|

| FY 2011 | • Introduced a Strategic Meeting System |

| FY 2013 | • Increased the number of outside directors from one to two |

| FY 2015 |

|

| FY 2017 | • Increased the number of outside directors from two to three |

| FY 2018 | • Established a business segment headquarters for each business segment, which oversees the business segment and its Group companies in Japan and overseas (moved to a system in which executive officers serve as general managers of business segments) |

| FY 2019 |

|

| FY 2020 | • Introduced a restricted stock compensation plan for directors (excluding outside directors) |

| FY 2021 | • Review of the committee structure, including establishment of the Sustainability Committee |

| FY 2022 | • Expanded the restricted stock compensation plan to include executive officers (excluding non-residents of Japan) |

Establishment of a Nomination and Remuneration Committee

In FY 2019, the Company established a Nomination and Remuneration Committee, which is chaired by an outside director, as a voluntary advisory body to the Board of Directors to bolster the independence, objectivity, and accountability of the Board of Directors.

This committee holds discussions for matters such as nominations and remunerations of directors and appointment and dismissal of the CEO and/or the COO, and reports to the Board of Directors.

Reasons for Appointments of the Independent Directors/Audit & Supervisory Board Members

Outside Directors

| Name | Reason for appointment | Attendance at meetings of the Board of Directors (FY 2024) |

|---|---|---|

| Keiichi Ando | Based on his wealth of knowledge and experience as a director of financial institutions, etc., the Company appointed Mr. Ando to receive advice on the areas of finance and corporate governance, while also receiving appropriate supervision of its management. We believe that, going forward, he will provide the Company with oversight from an objective and neutral standpoint. | Attended all 14 meetings |

| Hisae Kitayama | Based on her wealth of experience as a certified public accountant in an auditing firm and her high level of specialist knowledge regarding corporate accounting, the Company appointed Ms. Kitayama to receive advice on the area of accounting, while also receiving appropriate supervision of its management. We believe that, going forward, she will provide the Company with oversight from an objective and neutral standpoint. | Attended all 14 meetings |

| Takashi Tanisho | Mr. Tanisho has a wealth of experience and broad insight as a representative director at Kanadevia Corporation, and he provides accurate advice on the areas of manufacturing, technology, and management strategies, while also providing appropriate supervision of management. We believe that, going forward, he will provide the Company with oversight from an objective and neutral standpoint. | Attended all 14 meetings |

Outside Audit & Supervisory Board Members

| Name | Reason for appointment | Attendance at meetings of the Board of Directors and the Audit & Supervisory Board (FY 2024) |

|

|---|---|---|---|

| Kiyotaka Kawasaki | Mr. Kawasaki has high level of specialist knowledge regarding corporate legal affairs based on his many years of experience as an attorney. We believe that, going forward, he will audit the Company from a specialist point of view as well as from an objective and neutral standpoint. | Board of Directors Attended all 14 meetings |

Audit & Supervisory Board Attended all 17 meetings |

| Takaaki Yamamoto | Mr. Yamamoto has a high level of specialist knowledge regarding corporate legal affairs based on his many years of experience as an in-house attorney. We believe that, going forward, he will audit the Company from a specialist point of view as well as from an objective and neutral standpoint. | -- (For appointment on June 27, 2025) |

|

Compensation for the Directors and Audit & Supervisory Board Members

Compensation for Directors

The Board of Directors passed a resolution on the policy for determining the method for calculating compensation after deliberations and reporting by the Nomination and Remuneration Committee, a voluntary advisory body to the Board of Directors comprising a majority of outside directors.

So that compensation for internal directors provides an effective incentive for realizing sustainable improvements in corporate value over the long term, the Company has adopted a compensation system that focuses on the link between business performance and shareholder profit. Specifically, this system comprises fixed compensation and performance-based compensation, which are monetary compensation, and restricted stock compensation, which is non-monetary compensation.

Given that they perform the role of carrying out management supervision from an objective and neutral standpoint, compensation for outside directors comprises only fixed compensation, which is monetary compensation.

Compensation for the Audit & Supervisory Board Members

Given that they perform the role of carrying out management supervision from an objective and neutral standpoint, compensation for Audit & Supervisory Board members comprises only fixed compensation, which is monetary compensation.

We abolished director bonuses at the conclusion of the 97th Annual General Meeting of Shareholders held on June 29, 2006, and abolished the system of retirement benefits for directors at the conclusion of the 99th Annual General Meeting of Shareholders held on June 27, 2008. At the 111th Annual General Meeting of Shareholders held on June 26, 2020, the Company introduced restricted stock compensation on transfer to directors other than outside directors.

| Executive category | Total compensation amount (millions of yen) |

Total amount of each type of compensation (millions of yen) |

Number of applicable personnel |

||

|---|---|---|---|---|---|

| Fixed compensation | Performance-based compensation | Non-monetary compensation (restricted stock compensation) |

|||

| Directors (outside directors) |

224 (29) |

140 (29) |

55 | 29 | 6 (3) |

| Audit & Supervisory Board members (outside Audit & Supervisory Board members) |

63 (13) |

63 (13) |

- | - | 5 (3) |

*1 Numbers less than 1 million yen have been rounded down.

*2 The above includes one Audit & Supervisory Board Member whose terms of service concluded at the 115th Annual General Meeting of Shareholders held on June 27, 2024.

Evaluation of the Effectiveness of the Board of Directors

We have been evaluating the effectiveness of the Board of Directors since 2018 in order to improve its performance.

The Company requires all of its directors and Audit & Supervisory Board members to complete a questionnaire on matters including the Board of Directors’ structure, operation, and agenda items. Based on an analysis and evaluation of the questionnaire results, we have determined that the Board of Directors is functioning effectively.

Similar to previous occasions, at the most recent evaluation, numerous meaningful opinions were presented suggesting that we should further expand reporting and discussion at Board of Directors meetings on matters such as the policy for medium- and long-term allocation of management resources, our global management personnel training policy and diversification of management, risk management, and the content of discussions at the Nomination and Remuneration Committee. In order to respond to these opinions, we will endeavor to ensure the appropriate handling of investors’ opinions and the necessary reporting from each committee, and to further enhance and expand the ongoing provision of information through a variety of meetings besides Board of Directors meetings, including Board of Directors information exchange meetings, opinion exchange meetings, and Mid-Term Management Plan progress report meetings.

We will continue to examine improvements to further enhance the effectiveness of the Board of Directors.

Response to Japan’s Corporate Governance Code

For details on the Company’s corporate governance status and its compliance with the Corporate Governance Code, refer to the Corporate Governance Report as linked below.

Corporate Governance Report (0 bytes) *Japanese VersionInternal Control System

For the Company and other Group companies, we have formulated internal control regulations and established the Internal Control Committee in accordance with our Basic Policy on Internal Control. The Internal Control Committee is responsible for advancing ongoing initiatives in the following areas that are inclusive of the entire organization and participated in by all employees.

(1) Internal control initiatives stipulated by the Companies Act

We have established an emergency contact system on a global scale to enable information on risks that occur within the Group to be promptly communicated to senior management. We also implement annual risk management status surveys of major subsidiaries in Japan and overseas to ascertain the status of their risk management and follow up on their activities.

(2) Internal control initiatives described in the Financial Instruments and Exchange Act

Based on the Financial Instruments and Exchange Act, the Group has established internal control initiatives to ensure the appropriateness of the preparation process of its consolidated financial statements.

As overseas sales have increased in recent years, the number of overseas subsidiaries covered by these initiatives has increased each year. For this reason, with the aim of quickly introducing these initiatives at overseas subsidiaries, we are taking steps toward establishing related materials for, and the sharing of expertise with, overseas subsidiaries while concentrating efforts on enhancing the efficiency and accuracy of evaluations.

(3) Internal control initiatives conducted by the Group on a voluntary basis

The Group is advancing Tsubaki Internal Control Operation (TICO) initiatives for documenting the procedures of important work in each department. As activities that ensure the appropriateness of controls of risks for each type of work and objectively judge if there is unreasonableness or waste through visualizing important work, the TICO activities play a part in the Group’s important internal control initiatives.

* Tsubaki Internal Control Operation

Basic Policy on Internal ControlPolicy Shareholdings

Policies and Approach Regarding Reduced Policy Shareholdings

The Company maintains and strengthens its relationships with business partners through policy shareholdings, considers the activities necessary for the smooth promotion of its businesses, and has shares that are not purely for investment purposes, the subjects of which are business partners acknowledged as contributing to improved medium- to long-term corporate value for the Company.

Regarding these shareholdings, with the aim of realizing “Actions to Implement Management that is Conscious of Cost of Capital and Stock Price,” based on the merits of business that takes into account the status of transactions with the relevant policyholders, business profitability, returns and risks due to fluctuations in the market price of the shares in question, economic rationalities such as dividend profitability, and so on, for individual stocks, we also verify each year whether the continued holding of the shares in question contributes to improving the Company’s medium- to long-term corporate value, and we are advancing initiatives for reducing policy shareholdings, for example, through the sale at a suitable time of shares that are not deemed as rational to hold.

Details of Verifying the Propriety of Having Policy Shareholdings

Every year, the Board of Directors investigates issues such as whether the objectives are appropriate for individual stocks and their economic rationality, and makes decisions regarding policy shareholdings and their number.

Criteria for Exercising Voting Rights in Relation to Policy Shareholdings

Having fully considered the management policies, strategies, and so on of the investee company, we make a decision from the standpoint of matters such as whether the exercising of voting rights will lead to improved medium- to long-term corporate value for both the Tsubaki Group and the company in question.