Information Disclosure in Accordance with the TCFD

Basic Concept

Climate change can present major physical risks from rising temperatures to more intense weather events. From a business perspective, while the transition to decarbonization poses a risk that could have a significant impact on the Group’s business operations, business domains, and product concepts, we recognize that the implementation of appropriate countermeasures will provide opportunities to strengthen our corporate structure, improve competitiveness, and develop new markets and business opportunities.

In recognition of these circumstances, in March 2022, the Tsubaki Group announced its support of the Task Force on Climate-related Financial Disclosures (TCFD). Utilizing the information disclosure framework recommended by the TCFD, which includes the risks and opportunities posed by climate change, we will identify and evaluate our own risks and opportunities and reflect the relevant countermeasures in our business strategies. Moreover, we will proactively improve upon and disclose all relevant information on these initiatives through dialogue with stakeholders to enhance our corporate value. We also reviewed the content of our disclosures in March 2025.

* TCFD (Task Force on Climate-related Financial Disclosures): A task force that was established by the Financial Stability Board (FSB) in response to a request made at the G20 Finance Ministers and Central Bank Governors Meeting.

Endorsing the Task Force on Climate-related Financial Disclosures (TCFD)

Governance

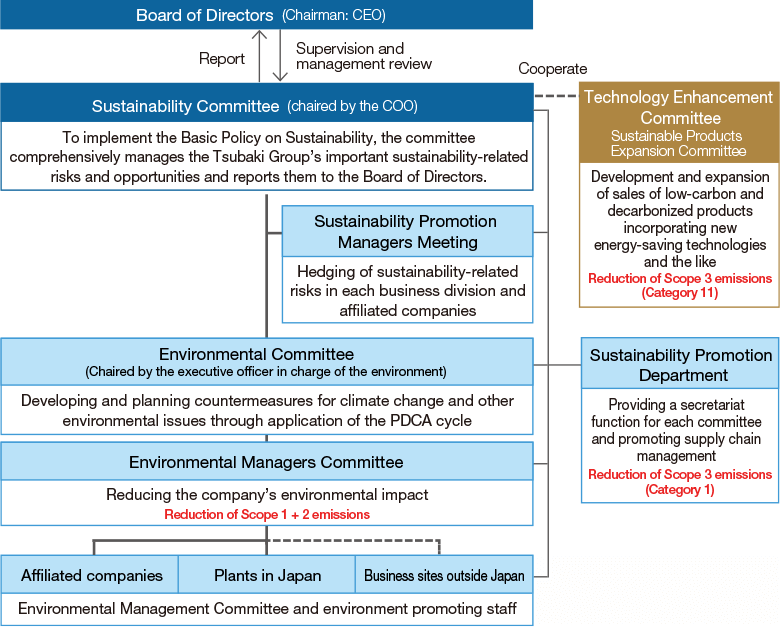

The Tsubaki Group’s sustainability initiatives are formulated by the Sustainability Committee, chaired by the COO, according to the terms of our Basic Policy on Sustainability.

The Sustainability Committee conducts risk assessments and assessments of importance of material issues with reference to information provided by each Committee such as the Environment, Quality, and Health and Safety and the Sustainability Promotion Managers Meeting, identifies important risks and opportunities for the Tsubaki Group, sets KPIs and targets, and comprehensively manages the progress of these initiatives. The Board of Directors receives regular reports from the Sustainability Committee on the status of initiatives and KPIs and the like. This system enables the Board of Directors to provide supervision.

Centered on the Tsubaki Group Environmental Committee, we are moving forward with specific initiatives to address environmental issues, including climate change. Based on the results of the assessments of importance of material issues implemented by the Sustainability Committee, the Environmental Committee will verify the demands of stakeholders and the progress of the company’s initiatives and evaluate the importance of environmental issues. We have also formulated an action plan in accordance with the Mid-term Management Plan for Carbon Neutrality and the CO2 Emissions Reduction Roadmap, and the entire Group is implementing the PDCA cycle with respect to all initiatives.

Climate Change-related Governance System

Scope 1: Direct emissions of greenhouse gases by the business operator itself (fuel combustion, production processes)

Scope 2: Indirect emissions associated with the use of electricity, heat, and steam supplied by other companies

Scope 3: Indirect emissions other than Scope 1 and Scope 2 (emissions of other companies related to the activities of the business operator)

| Chairman | Members | |

|---|---|---|

| Sustainability Committee |

COO | Executive officers in charge of business operations Secretariat: Executive officer in charge of sustainability Executive officer in charge of human resources |

| Sustainability Promotion Managers Meeting |

Executive officer in charge of sustainability | Managers of sustainability-related departments Secretariat: Sustainability Promotion Department |

| Environmental Committee | Executive officer in charge of the environment | General managers of Tsubakimoto Chain, Representatives of domestic manufacturing companies Secretariat: Sustainability Promotion Department |

Strategy (Scenario Analysis)

1. Implementation System and Scope of Scenario Analysis

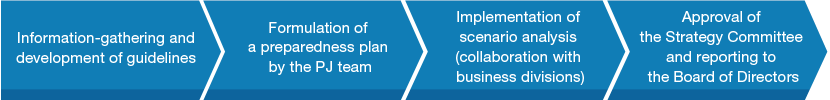

The Tsubaki Group organized its current status and issues regarding TCFD-recommended disclosures and decided on specific disclosures in 2022 through the following process. Since then, we have been regularly reviewing important risks and opportunities to better reflect these factors in our strategies.

Implementation System

Scope

| Business Scope | All business segments (Chain, Motion Control, Mobility, Materials Handling) |

|---|---|

| Regions Covered | All global regions |

| Target Subsidiaries | Consolidated subsidiaries |

2. Scenario Analysis Definitions

Definition of the Time Periods for the Evaluation of Climate Change Risks and Opportunities

| Period | Reason for Adoption | |

|---|---|---|

| Short | Through FY2025 | Medium-term environmental target period in line with Mid-Term Management Plan 2025 |

| Medium | Through FY2030 | Long-term environmental target period in line with Long-term Vision 2030 |

| Long | FY2031 and beyond | Period in line with the 2050 carbon neutrality goals |

Definition of Impacts

| Degree of Impact | Risks | Opportunities |

|---|---|---|

| High | Suspension of business activities/significant downsizing, etc. | Significant business expansion, etc. |

| Medium | Partial impact on business | Partial impact on business |

| Low | Limited impact | Limited impact |

3. Assessments of Importance of Risks and Opportunities

Climate change risks and opportunities are classified as either transition risks or physical risks, and the importance of each is assessed according to the risks and opportunities that are actually anticipated from both the magnitude and duration of the impact.

4. Definition of Scenario Groups

We analyze the risks and opportunities of climate change assuming a society in 2030 based on two scenarios: one in which the temperature rise is limited to within 1.5°C through a transition to a decarbonized society; and a scenario in which the temperature rise reaches 4°C.

| 4°C | 1.5°C | |

|---|---|---|

| Assumed Scenario | A world in which no measures are taken beyond the expected and the average temperature rises by more than 4°C within this century. Intensification of natural disasters will occur. | Efforts to mitigate climate change will be implemented, and greenhouse gas emissions will be virtually zero by 2050. |

| Predicted Changes in the External Environment | Progress was not achieved in the development of low-carbon technologies, the transition to renewable energy, or the adoption of zero-emission vehicles; natural disasters are more frequent and are becoming more intense.

(See figure below.) |

The frequency and scale of natural disasters are the same or slightly increased. The development of energy-saving technologies, the transition to renewable energy, and conversion to zero-emission automobiles are accelerated.

(See figure below.) |

| Reference Scenarios | IPCC/RCP8.5 Scenarios corresponding to the greatest greenhouse gas emissions in 2100 |

IPCC/SR1.5 The world depicted in the IPCC’s 1.5°C Special Report |

* When considering scenario analysis, we refer to the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC).

External Environment Change Forecast for Each Scenario

5. Business Impact Assessment

We are considering the impact that both of the above scenarios will have on financial indicators.

As shown in the figure, there are numerous transition risks and opportunities associated with climate change, and these are shown to have positive and negative impacts on both net sales and profit. The single most important issue for us could be considered to be how to minimize the risks and maximize the opportunities.

In the future, we believe it will be important to draw up scenarios for each business unit, and to analyze the impact on their respective performance statements (sales and operating income) and balance sheets (investment plans and ROE and the like).

“Transition” indicates transition risk; “Physical” represents physical risk.

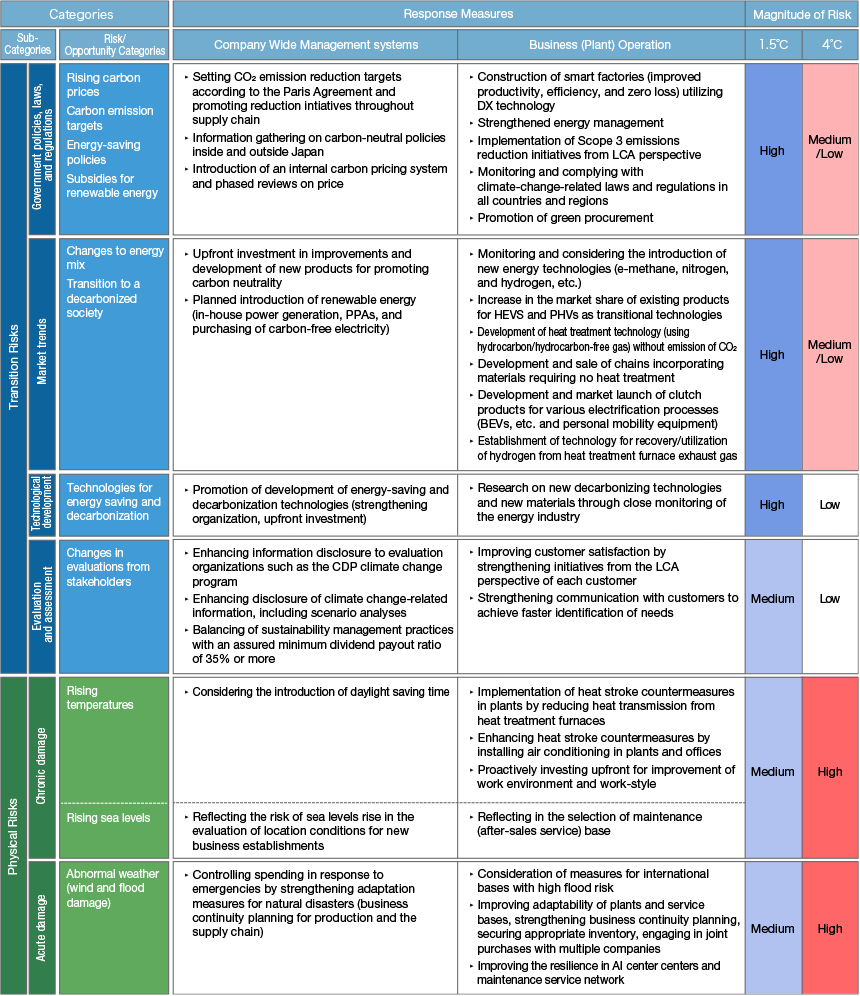

6. Scenario Analysis Results

Responding to and Addressing Risks

Regarding the risks identified in the scenario analysis, the magnitude of the risks and countermeasures are summarized.

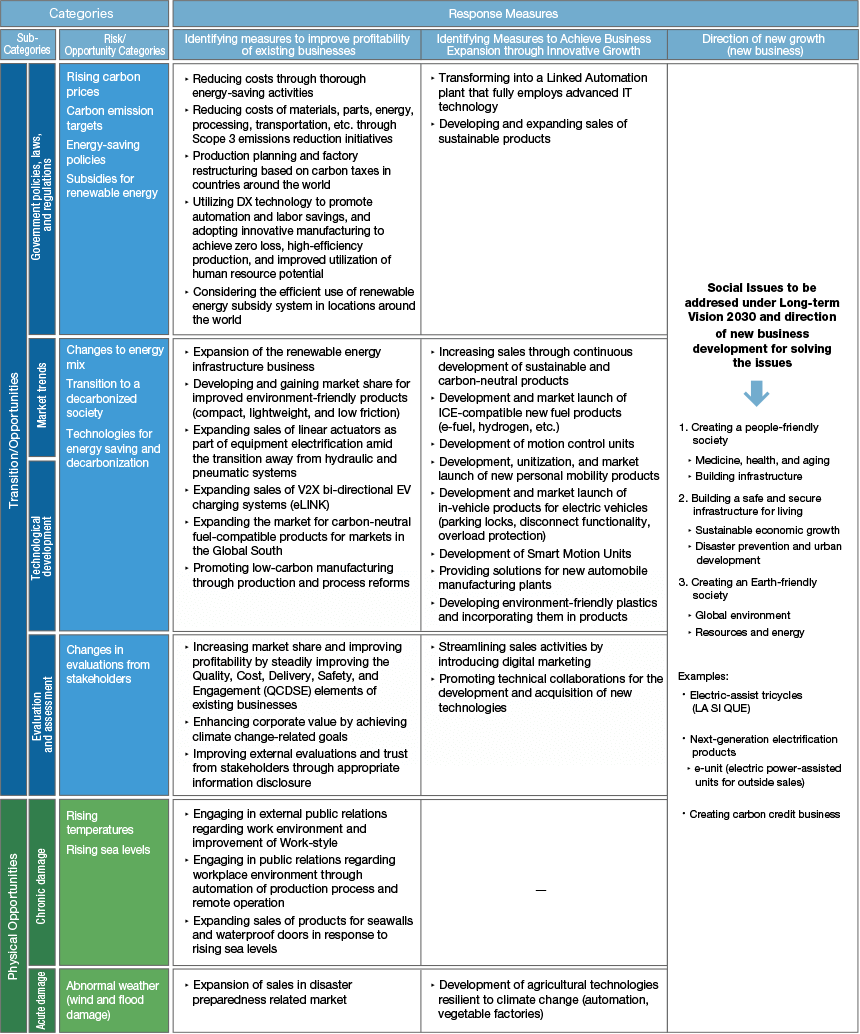

Measures in response to Opportunities

Under our Long-term Vision 2030, we examine risks and opportunities in terms of three factors: improving the profitability of existing businesses, expanding our business through innovative growth, and new growth (new businesses), and considering countermeasures.

Risk Management

The Tsubaki Group’s Risk Management System

The Tsubaki Group has established a Basic Risk Management Strategy, under which it strives to prevent the actualization of risks and minimize possible losses by continually identifying and understanding risk factors regarding a host of risks that could significantly impact management.

Under this system, we have established several committees regarding corporate ethics; information security; environment; quality; health and safety; and compliance and crisis management under the supervision of the Sustainability Committee in order to promote effective and efficient risk management.

These committees coordinate to promote risk countermeasures on a Groupwide basis by advancing various ongoing measures geared toward identifying and evaluating risk factors as well as preventing the actualization of these risks.

We also regularly assess the status of risks associated with each of our constituent companies and the status of response measures regarding such risks, and each committee undertakes specific risk management initiatives in each area according to the results of these evaluations.

These activities are reported to the Sustainability Committee and necessary instructions are provided at appropriate intervals.

Managing Environment-Related Risks and Opportunities

Regarding environment-related risks and opportunities, the Environmental Committee reviews the demands of stakeholders and the progress of Tsubaki’s own initiatives and reflects the results in a company-wide risk assessment table.

Each year, Group companies both in Japan and overseas use this risk assessment table to evaluate their environment-related risks, and those risks that must be addressed are incorporated into that company’s environmental management initiatives.

We recognize that climate change-related risks are one of the highest priority issues, and the Environmental Committee—under the Sustainability Committee—is dedicated to working on the issue as a common theme for the Group.

Indicators and Goals

We have adopted the Group’s medium- and long-term targets related to climate change as shown in the table below.

* This target was changed following SBT certification in 2023.

Use of Internal Carbon Pricing (ICP)

We introduced internal carbon pricing (ICP) in FY2023 to accelerate decarbonization efforts by setting a base price of 10,000 yen per ton of CO2 emissions.